Federal Solar Incentives Are Ending: A Data-Driven Breakdown of the Financial Impact

Oregon Governor Tina Kotek is in a race against the clock. With an executive order, she has directed state agencies to clear the bureaucratic hurdles for wind and solar projects, effectively hitting the accelerator on Oregon’s green energy ambitions. The move is a direct response to a rapidly approaching deadline: July 4, 2026. Miss that date, and a cascade of federal tax credits, the financial lifeblood for these massive projects, evaporates.

On the surface, this is a decisive, proactive measure. The governor’s statement frames it as a defensive action against a hostile federal environment, a necessary step to "step up as the last line of defense against climate catastrophe." Supporters have echoed this sentiment, painting the order as a shield against an "all-out assault on affordable clean energy."

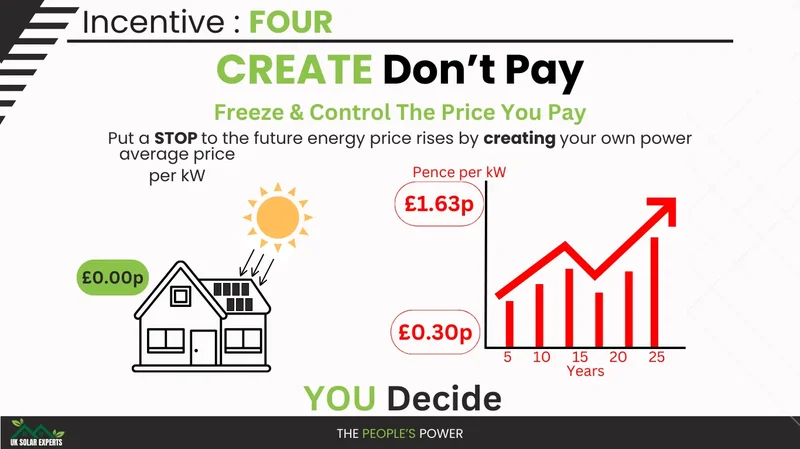

The numbers underpinning this urgency are stark. An analysis suggests that losing these credits—which can cover 30% to 50% of a project's cost—would jeopardize approximately 4 gigawatts of planned energy in Oregon. That’s enough to power roughly one million homes. Atlas Public Policy identifies 11 specific wind and solar projects currently walking this tightrope. You can almost hear the digital clock ticking in Salem, each second chipping away at billions in federal subsidies.

But a governor's order, however well-intentioned, can only influence the variables within its jurisdiction. And my analysis of the situation suggests the most significant variable in this equation lies far outside the governor's control.

The State-Level Solution to a Federal-Level Problem

Governor Kotek's order is a surgical instrument designed for a specific task: streamlining the state-level permitting process. It directs the Oregon Department of Energy and the Energy Facility Siting Council to prioritize approvals, a response to Oregon Fast-Tracks Renewable Energy Projects as Trump Bill Ends Tax Incentives - ProPublica, which highlighted the state’s own sluggish bureaucracy as a key impediment. This is a logical and necessary step. If your own house isn't in order, you can hardly blame the neighbors for a fire.

The problem is, this is like meticulously paving a new factory's loading docks and employee parking lot while ignoring the fact that the only road leading to the highway is a single-lane, gridlocked dirt path. The factory can be ready to ship, but if the trucks can't get out, production is meaningless.

In Oregon's energy landscape, that dirt path is the electrical grid. And the entity that owns and operates 75% of the transmission lines in the Northwest is the federal Bonneville Power Administration (BPA). Those lines are, for all intents and purposes, full. This isn't a new development; it's a long-term infrastructure deficit. Nicole Hughes of Renewable Northwest acknowledged the governor's order as a "good first step" but immediately pointed to the real issue: "massive transmission queue backlogs" at the federal level.

This is the critical discrepancy in the narrative. The political rhetoric focuses on state-level action and federal-level antagonism from the Trump administration's legislative changes. But the more immediate, physical barrier isn't a law; it's a lack of copper wire and substation capacity. You can't pass an executive order to create more transmission lines. What, precisely, is the point of a fast-tracked permit for a 200-megawatt solar farm if it has no viable way to plug into the grid and sell its power?

A Disconnect in the Data

The BPA, for its part, states it is working on the problem. A spokesperson noted a shift to a "first-ready, first-served" model for interconnection and expects to add 2 gigawatts of new energy to the grid by the end of 2028. I’ve looked at hundreds of these corporate and governmental projections, and this is the part of the statement that I find genuinely puzzling.

Let’s break down the numbers. The state is trying to save 4 gigawatts of projects facing a groundbreaking deadline in mid-2026. The federal operator is promising to add 2 gigawatts of capacity by the end of 2028. The timeline is misaligned, and the capacity is, at best, half of what's needed. The total at-risk capacity is 4 gigawatts—to be more exact, it's an estimated 4.1 GW across the 11 identified projects. The BPA's solution addresses, at most, 50% of the problem and delivers it two and a half years after the critical deadline has passed.

This raises a few pointed questions that the public statements don't address. How much of that planned 2 GW of new capacity is already spoken for by projects further ahead in the queue? More importantly, what is the specific, project-by-project interconnection timeline for the 11 Oregon projects at risk? A blanket promise of future capacity is not a bankable assurance for a project developer trying to secure financing today.

Other states (Colorado, Maine, and California) are facing the same federal deadline and are also streamlining their internal processes. They are all competing for the same limited grid connections and the same pool of specialized labor and materials. Oregon’s order helps it keep pace, but it doesn't give it a fundamental advantage in a national competition for scarce resources. The core constraint remains the physical capacity of the grid, a problem that requires billions of dollars and years of construction, not a signature on a state directive.

A Mismatch of Scale and Scope

Ultimately, my analysis suggests Governor Kotek's order is a necessary but profoundly insufficient action. It is a state-level administrative fix applied to a federal-level infrastructure crisis. While it will certainly help some projects on the margins and sends a powerful political message, it does not alter the fundamental physics of the electrical grid. The bottleneck isn't on paper in Salem; it's in the transmission substations and high-voltage lines managed by the BPA. Until that larger, more expensive, and far more complex problem is solved, Oregon is simply clearing one traffic jam to get to another, much larger one. The math just doesn't add up.

Related Articles

Flood Damage Restoration: What You Need to Know and Where to Find It

Portland's Water Woes: A Rising Tide for Restoration Services? Portland's Infrastructure Under Press...

Disaster: What happened?

Generated Title: Natural Disaster Response: Are We Really Getting Better At It? Okay, let's talk dis...

The Surprising Tech of Orvis: Why Their Fly Rods, Jackets, and Dog Beds Endure

When I first saw the headlines about Orvis closing 31 of its stores, I didn't feel a pang of nostalg...

MP Materials Stock Analysis: The Data Behind the 'Hold' Rating

The stock chart for MP Materials (MP) over the last 90 days looks less like a valuation curve and mo...

Oklo's Next-Gen Nuclear Power: The Breakthrough Technology & Its Vision for the Future

I was listening to the financial news the other day—a habit I keep not for stock tips, but for cultu...

RGTI Stock: A Comparative Analysis vs. IONQ and NVDA

The market action surrounding Rigetti Computing (RGTI) in 2025 presents a fascinating case study in...